Amazon.com: HD Blu-Ray Disc Player for TV with HDMI and AV Cables, Upscaling TV CD DVD Player 1080P, Built-in PAL NTSC, HDMI Output, AV Output, Coaxial Output, USB Input : Electronics

Amazon.com: Sony Blu Ray Player BDP BX370 with WiFi for Video Streaming and Screen Mirroring | Full HD Bluray Playback, DVD Upscaling | Includes Blue Ray DVD Player, Remote Control, HDMI Cable,

Sony BDP-BX370 Blu-ray Disc Player with Built-in Wi-Fi and HDMI Cable with Ultra USB Flash Drive 64GB

![Sony Multi Zone Region Free Blu Ray Player - PAL/NTSC Playback - Zone A B C - Region 1 2 3 4 5 6 [BDP-S1700] : Amazon.in: Electronics Sony Multi Zone Region Free Blu Ray Player - PAL/NTSC Playback - Zone A B C - Region 1 2 3 4 5 6 [BDP-S1700] : Amazon.in: Electronics](https://m.media-amazon.com/images/I/41q7E0xt-oL._AC_SS450_.jpg)

Sony Multi Zone Region Free Blu Ray Player - PAL/NTSC Playback - Zone A B C - Region 1 2 3 4 5 6 [BDP-S1700] : Amazon.in: Electronics

Asus BW-16D1HT Internal Blu-Ray Writer (16x BD-R (SL), 12x BD-R (DL), 16x DVD+/-R), BDXL, SATA - Black

Amazon.com: Sony BDP-S6700 4K Upscaling 3D Streaming Home Theater Blu-Ray Disc Player (Black) with Focus DVD Lens Cleaner and High Performance Bundle (3 Items) : Everything Else

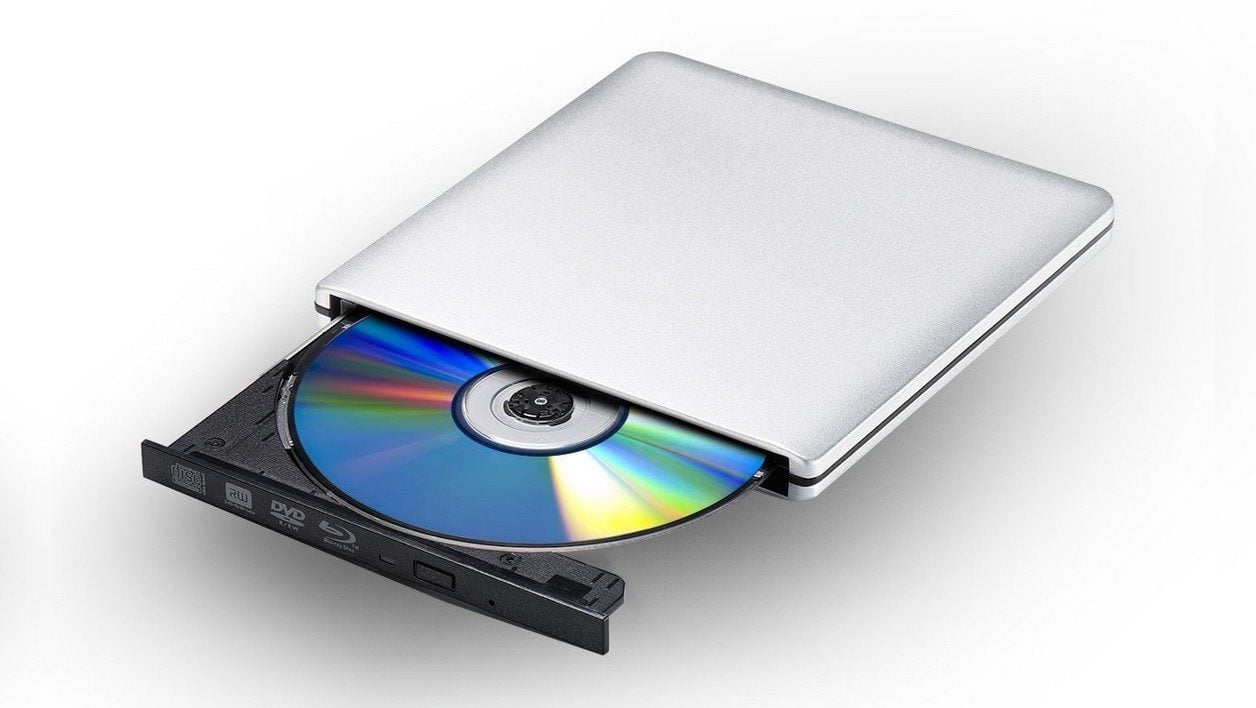

aelrsoch External Blu-ray Drive, USB External Blu-ray Writer, BD Drive CD DVD Drive Portable 3D Blu-ray Burner, USB 3.0 and Type-C External Blu-ray Reader, Suitable for Windows XP/7/8/10 : Amazon.co.uk: Computers &

Amazon.com: External blu ray Drive, Wintale USB3.0 Type-C External blu ray Burner Slim Optical CD DVD Drive Burner with SD/TF Card Reader/2 USB3.0 Hubs for pc Windows XP/7/8/10, MacOS, MacBook, Laptop, Desktop :

Amazon.com: LG All 3D Region Free Blu Ray Player - Modified Full Multi Zone A B C Playback - WiFi Compatible, 110-240 Volts Free 6FT HDMI Cable : Instrumental: Electronics

Amazon.com: External Blu ray Drive DVD/BD Player Read/Write Portable Blu-ray Drive USB 3.0 and Type-C DVD Burner 4k Ultra HD Blu-ray Drive Compatible with/Win7/Win8/Win10/ Win11 Blu ray Burner High SpeedSilent : Electronics